how long can you go without paying property taxes in missouri

In Michigan state law allows any public taxing agency -- state or local -- to claim a lien on property once 35 days have passed after a final bill is sent to the homeowner. For instance if the bill goes out on January 20 you wont get that 21-day window to pay by the 31st.

Missouri Estate Tax Everything You Need To Know Smartasset

If your tax bill is not mailed out until after January 10 your delinquency date will get pushed out.

. Other real estate parcels are eligible for tax foreclosure sale after taxes remain unpaid for 3 ½ years. Yes if income received in Missouri or earned in Missouri was greater than 600 for a nonresident or 1200 for a resident. A lienholder can foreclose on your property if you dont pay the lien within a reasonable timeframe.

If the tax was included in your monthly mortgage payments and. As for property taxes the homeowner forfeits the property to the agency in the second year of a tax delinquency. In Missouri a tax sale will typically take place if you dont pay the property taxes on your home for three years.

How long can property taxes go unpaid in Kansas. Every state and county may be a little different but there are tax incentives available to you as a real estate investor and property owner than you might know. Click to read full answer.

At the sale the winning bidder bids on the property and gets a certificate of purchase. If you own property in the US and the property is mortgaged not long at all if at all. Vacant lots with petitioned specials are eligible for tax foreclosure sale after real estate taxes remain unpaid for 2 ½ years.

Unlike mortgages which you have to pay off within a specified duration property taxes go on forever. As a part-year resident you generally have the option of claiming a Missouri resident credit Form MO-CR or Missouri income percentage Form MO-NRI. After the lien is placed on the property it usually takes 60 days to 120 days to be auctioned.

How Does A Tax Sale Work In Tennessee. But under state law it could take place sooner. ECheck - You will need your routing number and checking or savings account number.

No Right to Redeem After a Subsequent Sale If no one buys the property at the first second or third tax sale but it does sell at a subsequent offering you dont get a redemption period. You can go into foreclosure at any time when youre behind on your taxes. An eCheck is an easy and secure method to pay your individual income taxes by electronic bank draft.

What Happens Once You Fall Behind on Your Property Taxes. Please allow 3-4 business days for eCheck transactions to apply to your tax account. Depending on the state the redemption period might last from one year to three years.

How Long Can You Go Without Paying Property Taxes In Missouri. A property owner that is disabled may get an extension for property tax. Housing and jobs are only two of the criteria that you can provide that allows you to lower your tax bill and keep more money in your pocket.

Up to 25 cash back When a home sells at a third tax sale you get 90 days to redeem the property. Since Florida does not have a state income tax you are not. If its uncontested it can take about 60 days to complete.

Anybody above 65 years old if not able to pay the property tax can apply for the extension. If your home is sold for tax purposes you may redeem your home during the redemption period if the homeowner has the right to reside there. In this case the new delinquency date would be March 1.

Answer 1 of 13. The bank will collect the money to pay property taxes at the closing and then in every payment you make. The extensions would be granted to the person if the person becomes eligible for it.

Also what happens if you dont pay your car property taxes. There will be a handling fee of 050 to use this service. Its held in an escrow account by the bank and.

In most states its an extremely short period of time. The time would depend on various factors such as the income of the person and state laws. Municipalities are not allowed to collect property taxes after ten 10 years following the date that such taxes become delinquent due to lapse of tenth 10 years between those yearsThis is a general limit of 70 -1806.

Missouri Estate Tax Everything You Need To Know Smartasset

Pay Property Taxes Online Jackson County Mo

What Is A Homestead Exemption And How Does It Work Lendingtree

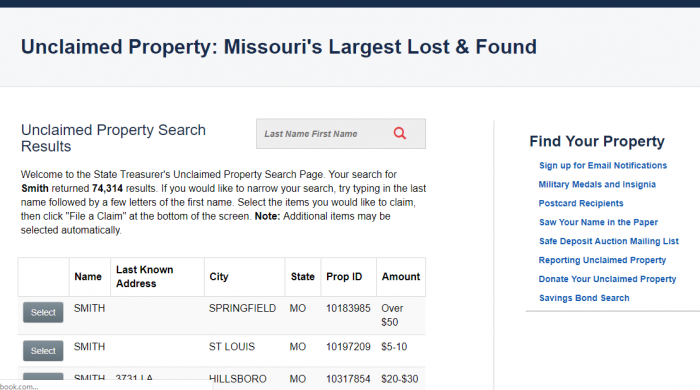

Missouri Unclaimed Money 2022 Guide Unclaimedmoneyfinder Org

Pin On Politics In The Early 1900s

Happy Buyers Become Repeat Buyers And We Deliver More Than Just A Good Product Or Sale To Keep It That Way T First Time Home Buyers House Hunting Kansas City

Missouri Property Tax H R Block

Personal Property Tax Jackson County Mo

Major Effects Of The Missouri Compromise Of 1820 In This Activity Students Will Use A Spider Graph To Bran Missouri Compromise Missouri History Lesson Plans

Missouri Senator Pushing To Eliminate Personal Property Taxes

I Am No Longer A Missouri Or A County Resident Do I Still Owe Clay County Missouri Tax